China's Ant Group is making waves in the AI-to-consumer market with Ant Afu, its upgraded health app that combines AI-powered companionship, Q&A, and health services.

Launched in mid-2025 and recently upgraded, Ant Afu has already surpassed 15 million monthly active users, making it the fastest-growing vertical AI application in China and reshaping how consumers interact with healthcare technology.

In 2025, Chinese tech giants saw technology, capital, narratives, traffic, and user interest converge around a single theme: AI for Consumers (AI-to-C). Following the Spring Festival, applications such as 『DeepSeek』 ignited a nationwide AI boom, driving user demand to unprecedented levels. ByteDance's Doubao and Tencent's Yuanbao achieved years' worth of growth in a single quarter, while Alibaba strategically positioned Quark and Qianwen to secure long-term ecosystem dominance.

For the first time, users recognized AI as a practical, everyday tool rather than a showcase for product launches. Internet companies also realized that a major restructuring of the digital ecosystem was underway, with clear winners and losers emerging in real time.

Unlike its competitors, Ant Group initially took a measured approach. Its national super-app Alipay and broad user base gave it the luxury of patience. By mid-2025, the company launched two major AI offerings: the health-focused app AQ, later upgraded to Ant Afu, and the lightweight general-purpose assistant Lingguang. Lingguang, which allows users to create custom AI apps quickly, achieved 2 million downloads within six days, demonstrating that Ant's approach to AI could also capture mainstream attention.

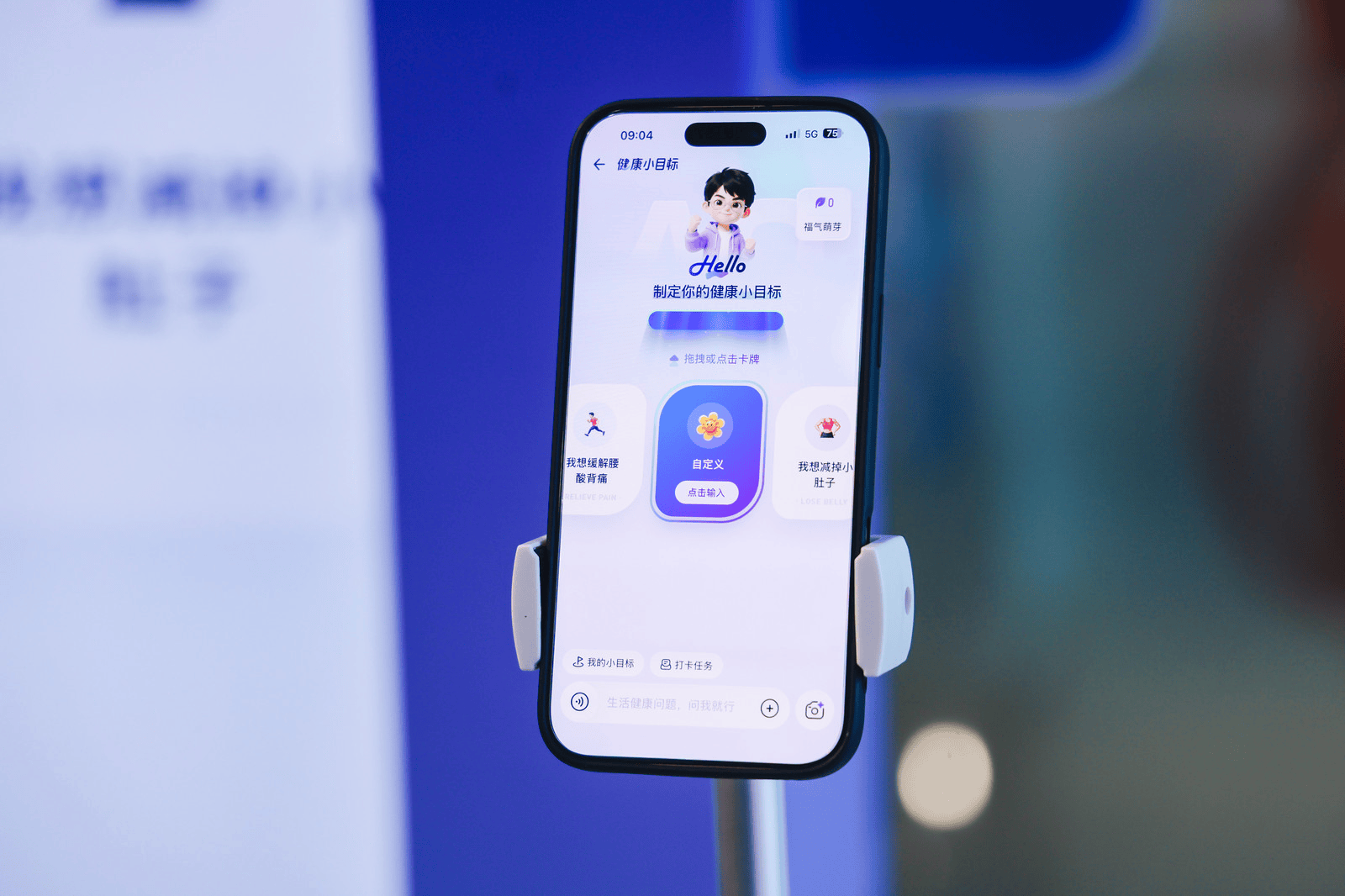

jrhz.infoAnt Afu, upgraded in December 2025, enhanced three core functions: health companionship, health Q&A, and health services. The app has evolved from a basic tool into a 24/7 AI health companion. Within months, its user base surged, climbing to fifth place in app store rankings and joining Doubao as one of the two leading AI consumer applications in China.

While other companies focus on general AI assistants, social ecosystems, or traffic-driven growth, Ant Group has taken an "unconventional" approach by doubling down on healthcare, a sector historically considered high-barrier, heavily regulated, and slow to scale.

On the AI-to-consumer battlefield, companies are pursuing different paths. Tencent integrates AI into social platforms like WeChat and QQ, focusing on content and engagement. ByteDance enhances short video and content personalization on Douyin and Toutiao. Alibaba relies on full-stack capabilities to power general-purpose AI products like Quark and Qianwen.

Ant Group, however, starts with the question: "Who needs AI the most?" Instead of chasing flashy features, its products focus on high-impact, professional user needs.

Lingguang innovates with "flash apps" that transform curiosity into lightweight, interactive experiences. Afu reflects Ant's deeper strategic intentions. According to Zhang Junjie, Vice President of Ant Group and President of Ant Health Division, "Afu"—meaning "health is a blessing"—is designed so users can turn to the app for all health-related guidance.

Afu is more than an AI medical advisor or a toolbox. Its priority on companionship signals its ambition to become an AI friend and guide, accessible 24/7. By addressing real and professional health needs, Afu fosters sustainable growth and user trust, giving it a durable advantage in a market often dominated by general-purpose AI assistants.

Ant's healthcare AI strategy builds on years of experience. The company has served 800 million medical insurance code users, established networks connecting millions of doctors, and partnered with over 5,000 hospitals. Its financial services background ensures robust security and compliance, a key differentiator in the healthcare sector.

Healthcare has become increasingly critical in China, where 310 million people are aged 60 or older—22% of the population—and over 500 million live with chronic diseases. Government initiatives like Healthy China 2030 have emphasized digital health innovation, and public awareness has grown in the post-pandemic era, shifting demand toward proactive, personalized health management.

Previously, healthcare posed a formidable challenge for tech companies due to regulatory hurdles, professional expertise requirements, and user sensitivity. AI large models now allow Ant Afu to provide personalized monitoring, auxiliary diagnostic support, and ongoing health companionship, transforming digital platforms into intelligent, proactive agents rather than passive information intermediaries.

Afu's evolution highlights AI's shift from tool to companion. In its 1.0 stage, it responded to user queries. In 2.0, Afu proactively asks follow-up questions, provides personalized guidance, and supports daily health management.

Vertical AI like Afu has attracted over 10 million monthly active users within six months, not through subsidies or aggressive traffic acquisition, but by addressing urgent, real-life health pain points. Middle-aged and elderly users, in particular, benefit from help interpreting reports or managing medication schedules, a gap traditional AI assistants struggle to fill.

Ant Afu's rise illustrates a clear strategic divergence in China's AI-to-consumer landscape. Tencent and ByteDance rely on content and traffic, Alibaba leverages full-stack AI capabilities, and Ant focuses on vertical AI that combines trust, professional expertise, and high user stickiness.

This approach suggests that vertical AI—in sectors like healthcare, finance, taxation, law, and banking—may become the next wave of strategic growth. These fields reward professional trust, ecosystem integration, and long-term engagement, providing competitive moats difficult to breach with general-purpose AI alone.

The AI-to-consumer race in 2025 is increasingly less about sheer technological superiority or traffic dominance. The initial success of Ant Afu suggests that usefulness and trust are now paramount. For consumers, AI's real value lies in solving frequent, urgent, and specialized daily problems, often in professional contexts with low tolerance for error.

The likely future will see coexistence between general-purpose AI and vertical AI: general AI handles everyday tasks, creativity, and inspiration, while vertical AI solves highly specialized, high-stakes problems. Both rely on evolving large-model technology and integrated industry capabilities.